Cannabis Taxes

-

California Cannabis Taxes Explained

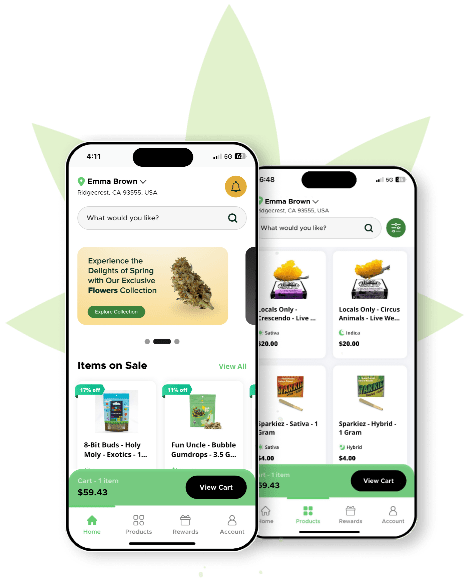

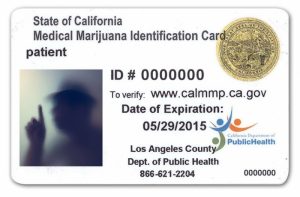

Cannabis is now legal for everyone over 21 in California, and that means unavoidable taxes – whether you have a doctor’s recommendation or not. In all, there are three types of California cannabis taxes. But medical card holders willing to jump through a few hoops can still claim one significant tax advantage: up to 7.25% off all retail marijuana purchases. It takes an extra step: Bring your recommendation to your county’s public health department, and for a $100 fee you’ll be issued a Medical Marijuana Identification (MMID) card that exempts you from “sales and use” tax for one year. In Kern County, the sales and use tax is 7.25%.

-

What are the three types of taxes on cannabis?

Excise Tax: This state tax is tied to the wholesale price, and comes out roughly to 15% of retail. It is generally the highest and most consistent tax on cannabis, and it cannot be avoided—not even discounts bring excise taxes down. (the State of California also has excise tax on alcohol, tobacco, and gasoline!) Local Tax: The City of California City taxes 6% on all cannabis retail sales, regardless of adult or medical use. Sales and Use Tax: Also a state tax, “sales and use” rates start at 7.25% California-wide, but grow quickly to 10% or more as jurisdictions add “district” taxes, some of them overlapping. (Here in Kern County, the sales and use tax is 7.25%). It is generally the second-highest tax on cannabis—it’s calculated upon the combined total of retail price, excise tax, AND local tax where applicable —and if you have an MMID card, you don’t have to pay it! -

Why doesn’t my doctor’s recommendation exempt me automatically?

Because it’s not registered with the state of California, which collects sales and use taxes. A doctor’s recommendation is a statement from a state-licensed physician that allowed patients to purchase medical marijuana from licensed dispensaries prior to January 1, 2018. They’re still available, but you no longer need one to purchase cannabis in California if you’re 21 or older, unless you plan to purchase more than the State daily limit. A Medical Marijuana Identification Card is a state-issued license that allows you to buy cannabis without paying sales and use tax. MMIDs require a doctor’s recommendation—your current one will do, as there is no additional screening—to be registered at your county’s public health department. A state MMID costs $100 annually.

Greenstone Cannabis Retail Store serving the California City, CA area.